Childcare Taxes 2025: A Comprehensive Resource for Providers and Guardians

Daniel McDonnell

7 min read

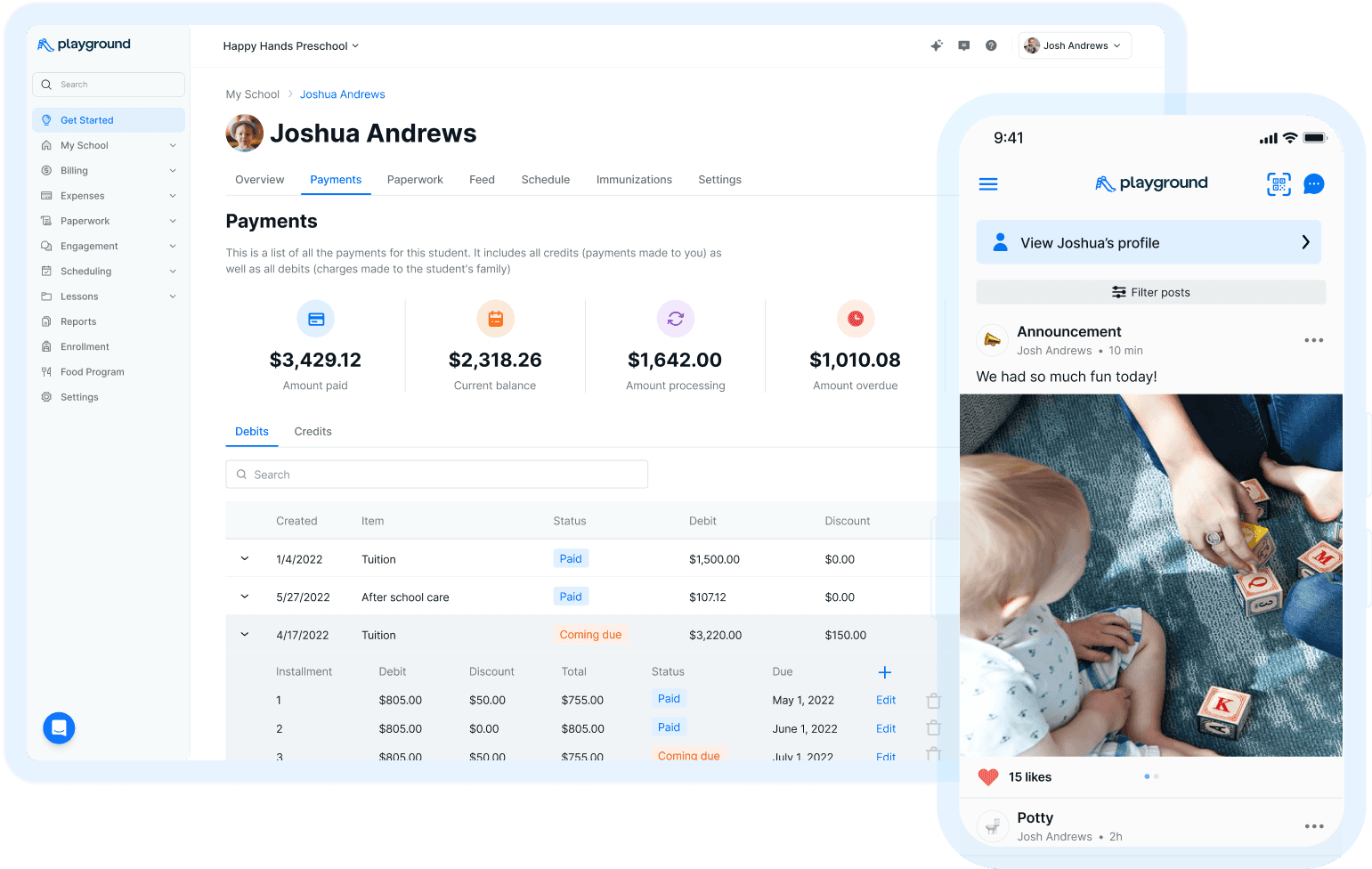

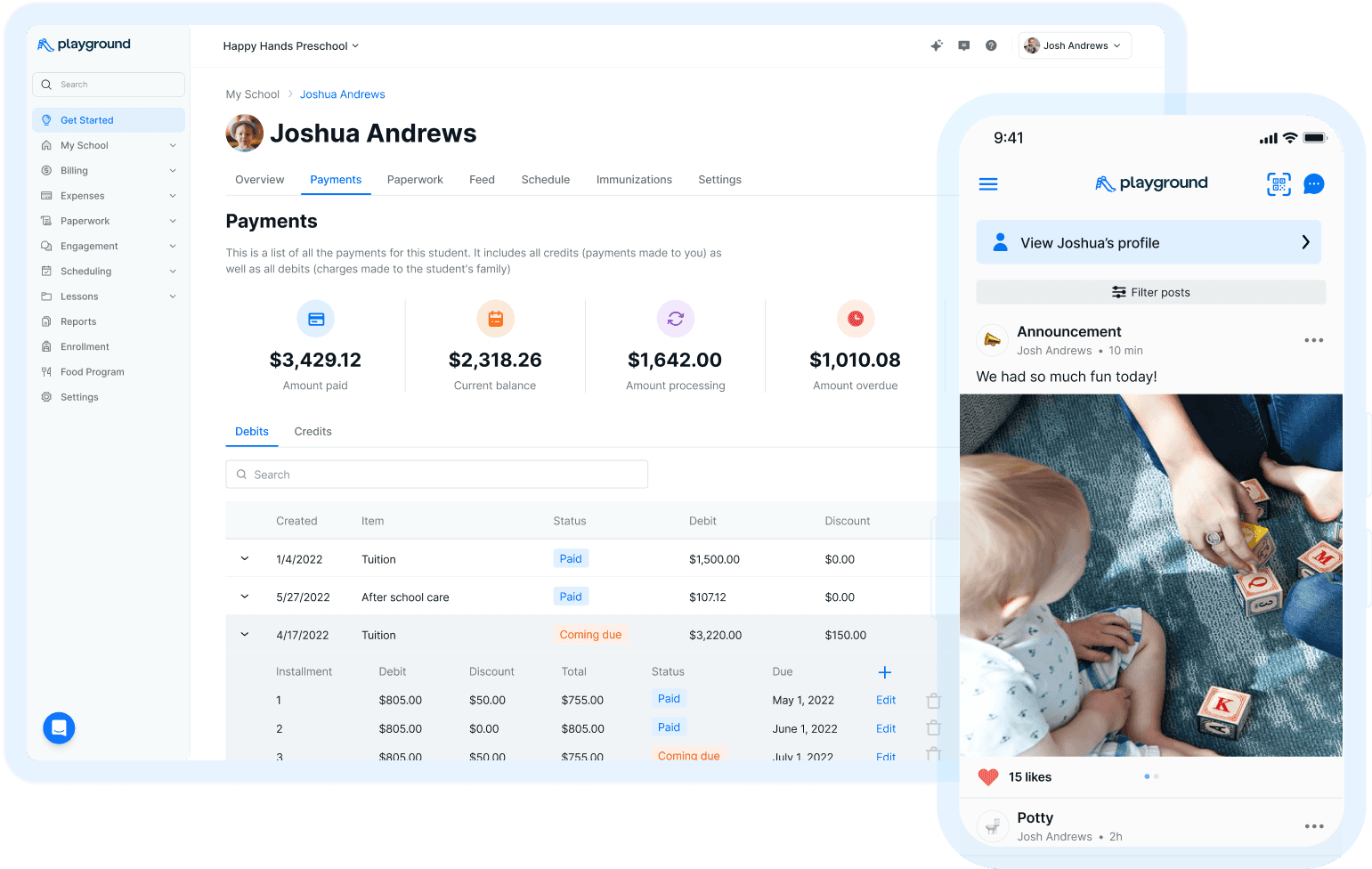

Make your families & teachers happier

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

Make your families & teachers happier

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

Tax season is no one’s favorite time of year and can be a challenge for childcare providers and guardians. But the silver lining is, if done strategically, they can be an opportunity for major savings through deductions and credits. Daycare owners managing payroll and guardians seeking relief for childcare costs alike should understand the ins and outs of childcare taxes.

Have you ever begun working on your taxes, only to feel completely lost and overwhelmed? You’re not alone. This guide breaks it all down with clear steps, expert advice, and helpful resources to make navigating the 2025 tax season easier and more manageable.

Understanding childcare taxes

Making sense of the financial aspects of childcare is a challenge no matter which way you spin it—particularly when it comes to taxes. For providers, it means managing income reporting, self-employment taxes, and maximizing deductions for business-related expenses. For guardians, it offers potential relief through tax credits designed to ease the cost of care. Understanding both tax rules and opportunities helps ensure compliance with IRS guidelines and opens doors to financial benefits that can make childcare more manageable.

What are childcare taxes?

Childcare taxes include the financial obligations and benefits tied to childcare services. For providers, these are:

Reporting income earned from childcare services

Paying self-employment and payroll taxes if applicable

Taking advantage of deductions for business-related expenses

For guardians, childcare taxes often involve claiming credits to reduce the burden of care costs. The IRS provides clear guidelines on eligible deductions and credits, making it easier to ensure compliance while minimizing tax liability.

Who needs to file?

Childcare Owners/Providers: Anyone who earns income from childcare services, including in-home providers, daycare operators, and babysitters working as independent contractors.

Guardians: Families who pay for childcare and meet specific eligibility criteria to claim credits.

Key tax credits for childcare providers and guardians

Paying for childcare or running a childcare business comes with its share of financial challenges, but tax credits can help lighten the load. These credits are powerful tools that reduce your tax bill dollar for dollar, making a significant difference when budgets are tight. For guardians, these credits can help you to focus on work, school, or career-building without feeling the full financial pinch of ensuring your child is cared for. For providers, understanding the right credits can mean more money stays in your pocket while you grow your business.

Finding credits that apply to you

From the Child and Dependent Care Tax Credit, designed to help guardians manage care costs, to the Employer-Provided Childcare Tax Credit, which lets businesses support employees while cutting their own tax bills, there’s something for nearly everyone. And let’s not forget the Earned Income Tax Credit (EITC), which gives low- to moderate-income families extra support when needed. Each of these credits has its own rules and opportunities, but with some planning and the right documentation, they can add up to real savings. Here are the need-to-know details:

Child and dependent care tax credit

Covers up to $3,000 for one child or $6,000 for two or more children.

To qualify, childcare expenses must enable guardians to work, look for work, or attend school full-time.

Documentation needed includes receipts from the provider and their EIN or Social Security number.

Employer-provided childcare tax credit

For businesses offering childcare benefits to employees:

Covers 25% of qualifying childcare expenses and 10% of resource and referral costs.

Small businesses can leverage this to support employees while reducing their own tax liability.

Earned income tax credit (EITC)

Targets low- to moderate-income families.

The amount depends on income and number of dependents.

Families may qualify for both the EITC and Child and Dependent Care Tax Credit.

Pro Tip: Guardians should consider pairing these credits with flexible spending accounts (FSAs) to save even more.

Tax deductions for childcare providers

Running a childcare business can be incredibly rewarding, but let’s face it—managing the financial side can feel like a full-time job in itself. Think about all the costs that go into running your business—rent, utilities, supplies, and even meals for the children in your care. These are just a few of the everyday expenses you could be writing off. Have you made a big investment, like a new playset or furniture? The IRS allows you to deduct those costs over time through depreciation. And don’t forget about mileage; even driving to pick up craft supplies or attend a training session can qualify.

Home office deduction

If you operate your childcare business from home, you can deduct a percentage of your:

Rent or mortgage

Utilities, insurance, and maintenance costs

The IRS allows two methods for calculating this: the simplified option or the actual expense method. Use Form 8829 to determine your deduction.

Business expenses

Providers can deduct a wide range of expenses, including:

Supplies: Crayons, toys, books, and cleaning products

Meals and Snacks: Costs associated with providing food for children in your care

Training and Certifications: Any courses or fees required to maintain licensing

Depreciation on assets

Larger purchases like furniture, appliances, and playground equipment can be depreciated over several years. Example: A $3,000 playset used exclusively for the business can be deducted in increments.

Mileage and transportation

If you drive for work purposes, such as picking up supplies or attending training sessions, you can deduct mileage.

Pro Tip: Use apps like MileIQ to track your business-related travel.

How to prepare for tax season

Being prepared can make tax season far less stressful—and hopefully even rewarding. Instead of scrambling to gather receipts or double-check forms at the last minute, a little organization throughout the year can save you time and headaches. For childcare providers, preparation also means understanding how to handle audits, keeping accurate records, and ensuring compliance with IRS rules. By breaking it all into manageable steps and using the right tools, you can make tax season a breeze! Follow these steps to stay organized:

Organizing financial records

Keep receipts for all business expenses, from snacks to cleaning supplies.

Maintain a log of income, including payments received through checks, apps, or cash.

Estimated tax payments

Self-employed providers must make quarterly estimated tax payments to avoid IRS penalties. The deadlines for 2025 are:

April 15, June 15, September 15, and January 15.

But if you decide to pay yourself as a W2 employee, Playground’s Payroll takes the headache out of payroll taxes by calculating and filing them for you. Imagine the peace of mind knowing it’s all handled accurately and on time for you–without penalties?

Navigating audits and compliance

Avoid IRS scrutiny by ensuring your reported income matches the total payments received.

Cross-check payroll summaries against issued W-2s and 1099s.

Double-check that your deductions meet IRS eligibility criteria.

Pro Tip: Run a payroll report before the end of the year to identify and correct errors early.

Expert tips to maximize tax savings

When completing childcare taxes, you should make the most of every opportunity to save. Go beyond the basics and tap into expert insights that can help you keep more of what you’ve earned. Here are some expert tips to make sure you leave no stone unturned.

Hire a tax professional

A certified tax professional can help you:

Identify lesser-known deductions

Navigate changes in tax laws

Ensure accurate filings to avoid penalties

Stay updated on tax laws

Tax codes change annually, so keeping up-to-date is essential. For instance:

The Employee Retention Credit under the CARES Act allowed retroactive claims for eligible wages.

New inflation adjustments may impact deduction limits and credit thresholds in 2025.

FAQ on childcare taxes

Q: What documents do I need to file?

Income statements (invoices, 1099s, etc.).

Receipts for business expenses.

Mileage logs if claiming transportation deductions.

Q: Can parents and providers claim the same expenses?

No, expenses cannot be double-claimed. Parents claim credits, while providers claim deductions.

Q: What is the deadline for filing payroll taxes?

W-2s and 1099s must be delivered by January 31, 2025. Payroll by Playground delivers the right documentation to your employees for you.

Childcare taxes don’t have to be intimidating. By understanding the basics, leveraging credits and deductions, and staying organized, you can simplify the process and save money.

Start early, keep thorough records, and consult professionals when needed. For more tips, watch our webinar, Navigating Tax Season 2025 with Playground, or explore tools like Playground Payroll to simplify your tax filings. Here’s to a successful 2025 tax season.

Tax season is no one’s favorite time of year and can be a challenge for childcare providers and guardians. But the silver lining is, if done strategically, they can be an opportunity for major savings through deductions and credits. Daycare owners managing payroll and guardians seeking relief for childcare costs alike should understand the ins and outs of childcare taxes.

Have you ever begun working on your taxes, only to feel completely lost and overwhelmed? You’re not alone. This guide breaks it all down with clear steps, expert advice, and helpful resources to make navigating the 2025 tax season easier and more manageable.

Understanding childcare taxes

Making sense of the financial aspects of childcare is a challenge no matter which way you spin it—particularly when it comes to taxes. For providers, it means managing income reporting, self-employment taxes, and maximizing deductions for business-related expenses. For guardians, it offers potential relief through tax credits designed to ease the cost of care. Understanding both tax rules and opportunities helps ensure compliance with IRS guidelines and opens doors to financial benefits that can make childcare more manageable.

What are childcare taxes?

Childcare taxes include the financial obligations and benefits tied to childcare services. For providers, these are:

Reporting income earned from childcare services

Paying self-employment and payroll taxes if applicable

Taking advantage of deductions for business-related expenses

For guardians, childcare taxes often involve claiming credits to reduce the burden of care costs. The IRS provides clear guidelines on eligible deductions and credits, making it easier to ensure compliance while minimizing tax liability.

Who needs to file?

Childcare Owners/Providers: Anyone who earns income from childcare services, including in-home providers, daycare operators, and babysitters working as independent contractors.

Guardians: Families who pay for childcare and meet specific eligibility criteria to claim credits.

Key tax credits for childcare providers and guardians

Paying for childcare or running a childcare business comes with its share of financial challenges, but tax credits can help lighten the load. These credits are powerful tools that reduce your tax bill dollar for dollar, making a significant difference when budgets are tight. For guardians, these credits can help you to focus on work, school, or career-building without feeling the full financial pinch of ensuring your child is cared for. For providers, understanding the right credits can mean more money stays in your pocket while you grow your business.

Finding credits that apply to you

From the Child and Dependent Care Tax Credit, designed to help guardians manage care costs, to the Employer-Provided Childcare Tax Credit, which lets businesses support employees while cutting their own tax bills, there’s something for nearly everyone. And let’s not forget the Earned Income Tax Credit (EITC), which gives low- to moderate-income families extra support when needed. Each of these credits has its own rules and opportunities, but with some planning and the right documentation, they can add up to real savings. Here are the need-to-know details:

Child and dependent care tax credit

Covers up to $3,000 for one child or $6,000 for two or more children.

To qualify, childcare expenses must enable guardians to work, look for work, or attend school full-time.

Documentation needed includes receipts from the provider and their EIN or Social Security number.

Employer-provided childcare tax credit

For businesses offering childcare benefits to employees:

Covers 25% of qualifying childcare expenses and 10% of resource and referral costs.

Small businesses can leverage this to support employees while reducing their own tax liability.

Earned income tax credit (EITC)

Targets low- to moderate-income families.

The amount depends on income and number of dependents.

Families may qualify for both the EITC and Child and Dependent Care Tax Credit.

Pro Tip: Guardians should consider pairing these credits with flexible spending accounts (FSAs) to save even more.

Tax deductions for childcare providers

Running a childcare business can be incredibly rewarding, but let’s face it—managing the financial side can feel like a full-time job in itself. Think about all the costs that go into running your business—rent, utilities, supplies, and even meals for the children in your care. These are just a few of the everyday expenses you could be writing off. Have you made a big investment, like a new playset or furniture? The IRS allows you to deduct those costs over time through depreciation. And don’t forget about mileage; even driving to pick up craft supplies or attend a training session can qualify.

Home office deduction

If you operate your childcare business from home, you can deduct a percentage of your:

Rent or mortgage

Utilities, insurance, and maintenance costs

The IRS allows two methods for calculating this: the simplified option or the actual expense method. Use Form 8829 to determine your deduction.

Business expenses

Providers can deduct a wide range of expenses, including:

Supplies: Crayons, toys, books, and cleaning products

Meals and Snacks: Costs associated with providing food for children in your care

Training and Certifications: Any courses or fees required to maintain licensing

Depreciation on assets

Larger purchases like furniture, appliances, and playground equipment can be depreciated over several years. Example: A $3,000 playset used exclusively for the business can be deducted in increments.

Mileage and transportation

If you drive for work purposes, such as picking up supplies or attending training sessions, you can deduct mileage.

Pro Tip: Use apps like MileIQ to track your business-related travel.

How to prepare for tax season

Being prepared can make tax season far less stressful—and hopefully even rewarding. Instead of scrambling to gather receipts or double-check forms at the last minute, a little organization throughout the year can save you time and headaches. For childcare providers, preparation also means understanding how to handle audits, keeping accurate records, and ensuring compliance with IRS rules. By breaking it all into manageable steps and using the right tools, you can make tax season a breeze! Follow these steps to stay organized:

Organizing financial records

Keep receipts for all business expenses, from snacks to cleaning supplies.

Maintain a log of income, including payments received through checks, apps, or cash.

Estimated tax payments

Self-employed providers must make quarterly estimated tax payments to avoid IRS penalties. The deadlines for 2025 are:

April 15, June 15, September 15, and January 15.

But if you decide to pay yourself as a W2 employee, Playground’s Payroll takes the headache out of payroll taxes by calculating and filing them for you. Imagine the peace of mind knowing it’s all handled accurately and on time for you–without penalties?

Navigating audits and compliance

Avoid IRS scrutiny by ensuring your reported income matches the total payments received.

Cross-check payroll summaries against issued W-2s and 1099s.

Double-check that your deductions meet IRS eligibility criteria.

Pro Tip: Run a payroll report before the end of the year to identify and correct errors early.

Expert tips to maximize tax savings

When completing childcare taxes, you should make the most of every opportunity to save. Go beyond the basics and tap into expert insights that can help you keep more of what you’ve earned. Here are some expert tips to make sure you leave no stone unturned.

Hire a tax professional

A certified tax professional can help you:

Identify lesser-known deductions

Navigate changes in tax laws

Ensure accurate filings to avoid penalties

Stay updated on tax laws

Tax codes change annually, so keeping up-to-date is essential. For instance:

The Employee Retention Credit under the CARES Act allowed retroactive claims for eligible wages.

New inflation adjustments may impact deduction limits and credit thresholds in 2025.

FAQ on childcare taxes

Q: What documents do I need to file?

Income statements (invoices, 1099s, etc.).

Receipts for business expenses.

Mileage logs if claiming transportation deductions.

Q: Can parents and providers claim the same expenses?

No, expenses cannot be double-claimed. Parents claim credits, while providers claim deductions.

Q: What is the deadline for filing payroll taxes?

W-2s and 1099s must be delivered by January 31, 2025. Payroll by Playground delivers the right documentation to your employees for you.

Childcare taxes don’t have to be intimidating. By understanding the basics, leveraging credits and deductions, and staying organized, you can simplify the process and save money.

Start early, keep thorough records, and consult professionals when needed. For more tips, watch our webinar, Navigating Tax Season 2025 with Playground, or explore tools like Playground Payroll to simplify your tax filings. Here’s to a successful 2025 tax season.

Tax season is no one’s favorite time of year and can be a challenge for childcare providers and guardians. But the silver lining is, if done strategically, they can be an opportunity for major savings through deductions and credits. Daycare owners managing payroll and guardians seeking relief for childcare costs alike should understand the ins and outs of childcare taxes.

Have you ever begun working on your taxes, only to feel completely lost and overwhelmed? You’re not alone. This guide breaks it all down with clear steps, expert advice, and helpful resources to make navigating the 2025 tax season easier and more manageable.

Understanding childcare taxes

Making sense of the financial aspects of childcare is a challenge no matter which way you spin it—particularly when it comes to taxes. For providers, it means managing income reporting, self-employment taxes, and maximizing deductions for business-related expenses. For guardians, it offers potential relief through tax credits designed to ease the cost of care. Understanding both tax rules and opportunities helps ensure compliance with IRS guidelines and opens doors to financial benefits that can make childcare more manageable.

What are childcare taxes?

Childcare taxes include the financial obligations and benefits tied to childcare services. For providers, these are:

Reporting income earned from childcare services

Paying self-employment and payroll taxes if applicable

Taking advantage of deductions for business-related expenses

For guardians, childcare taxes often involve claiming credits to reduce the burden of care costs. The IRS provides clear guidelines on eligible deductions and credits, making it easier to ensure compliance while minimizing tax liability.

Who needs to file?

Childcare Owners/Providers: Anyone who earns income from childcare services, including in-home providers, daycare operators, and babysitters working as independent contractors.

Guardians: Families who pay for childcare and meet specific eligibility criteria to claim credits.

Key tax credits for childcare providers and guardians

Paying for childcare or running a childcare business comes with its share of financial challenges, but tax credits can help lighten the load. These credits are powerful tools that reduce your tax bill dollar for dollar, making a significant difference when budgets are tight. For guardians, these credits can help you to focus on work, school, or career-building without feeling the full financial pinch of ensuring your child is cared for. For providers, understanding the right credits can mean more money stays in your pocket while you grow your business.

Finding credits that apply to you

From the Child and Dependent Care Tax Credit, designed to help guardians manage care costs, to the Employer-Provided Childcare Tax Credit, which lets businesses support employees while cutting their own tax bills, there’s something for nearly everyone. And let’s not forget the Earned Income Tax Credit (EITC), which gives low- to moderate-income families extra support when needed. Each of these credits has its own rules and opportunities, but with some planning and the right documentation, they can add up to real savings. Here are the need-to-know details:

Child and dependent care tax credit

Covers up to $3,000 for one child or $6,000 for two or more children.

To qualify, childcare expenses must enable guardians to work, look for work, or attend school full-time.

Documentation needed includes receipts from the provider and their EIN or Social Security number.

Employer-provided childcare tax credit

For businesses offering childcare benefits to employees:

Covers 25% of qualifying childcare expenses and 10% of resource and referral costs.

Small businesses can leverage this to support employees while reducing their own tax liability.

Earned income tax credit (EITC)

Targets low- to moderate-income families.

The amount depends on income and number of dependents.

Families may qualify for both the EITC and Child and Dependent Care Tax Credit.

Pro Tip: Guardians should consider pairing these credits with flexible spending accounts (FSAs) to save even more.

Tax deductions for childcare providers

Running a childcare business can be incredibly rewarding, but let’s face it—managing the financial side can feel like a full-time job in itself. Think about all the costs that go into running your business—rent, utilities, supplies, and even meals for the children in your care. These are just a few of the everyday expenses you could be writing off. Have you made a big investment, like a new playset or furniture? The IRS allows you to deduct those costs over time through depreciation. And don’t forget about mileage; even driving to pick up craft supplies or attend a training session can qualify.

Home office deduction

If you operate your childcare business from home, you can deduct a percentage of your:

Rent or mortgage

Utilities, insurance, and maintenance costs

The IRS allows two methods for calculating this: the simplified option or the actual expense method. Use Form 8829 to determine your deduction.

Business expenses

Providers can deduct a wide range of expenses, including:

Supplies: Crayons, toys, books, and cleaning products

Meals and Snacks: Costs associated with providing food for children in your care

Training and Certifications: Any courses or fees required to maintain licensing

Depreciation on assets

Larger purchases like furniture, appliances, and playground equipment can be depreciated over several years. Example: A $3,000 playset used exclusively for the business can be deducted in increments.

Mileage and transportation

If you drive for work purposes, such as picking up supplies or attending training sessions, you can deduct mileage.

Pro Tip: Use apps like MileIQ to track your business-related travel.

How to prepare for tax season

Being prepared can make tax season far less stressful—and hopefully even rewarding. Instead of scrambling to gather receipts or double-check forms at the last minute, a little organization throughout the year can save you time and headaches. For childcare providers, preparation also means understanding how to handle audits, keeping accurate records, and ensuring compliance with IRS rules. By breaking it all into manageable steps and using the right tools, you can make tax season a breeze! Follow these steps to stay organized:

Organizing financial records

Keep receipts for all business expenses, from snacks to cleaning supplies.

Maintain a log of income, including payments received through checks, apps, or cash.

Estimated tax payments

Self-employed providers must make quarterly estimated tax payments to avoid IRS penalties. The deadlines for 2025 are:

April 15, June 15, September 15, and January 15.

But if you decide to pay yourself as a W2 employee, Playground’s Payroll takes the headache out of payroll taxes by calculating and filing them for you. Imagine the peace of mind knowing it’s all handled accurately and on time for you–without penalties?

Navigating audits and compliance

Avoid IRS scrutiny by ensuring your reported income matches the total payments received.

Cross-check payroll summaries against issued W-2s and 1099s.

Double-check that your deductions meet IRS eligibility criteria.

Pro Tip: Run a payroll report before the end of the year to identify and correct errors early.

Expert tips to maximize tax savings

When completing childcare taxes, you should make the most of every opportunity to save. Go beyond the basics and tap into expert insights that can help you keep more of what you’ve earned. Here are some expert tips to make sure you leave no stone unturned.

Hire a tax professional

A certified tax professional can help you:

Identify lesser-known deductions

Navigate changes in tax laws

Ensure accurate filings to avoid penalties

Stay updated on tax laws

Tax codes change annually, so keeping up-to-date is essential. For instance:

The Employee Retention Credit under the CARES Act allowed retroactive claims for eligible wages.

New inflation adjustments may impact deduction limits and credit thresholds in 2025.

FAQ on childcare taxes

Q: What documents do I need to file?

Income statements (invoices, 1099s, etc.).

Receipts for business expenses.

Mileage logs if claiming transportation deductions.

Q: Can parents and providers claim the same expenses?

No, expenses cannot be double-claimed. Parents claim credits, while providers claim deductions.

Q: What is the deadline for filing payroll taxes?

W-2s and 1099s must be delivered by January 31, 2025. Payroll by Playground delivers the right documentation to your employees for you.

Childcare taxes don’t have to be intimidating. By understanding the basics, leveraging credits and deductions, and staying organized, you can simplify the process and save money.

Start early, keep thorough records, and consult professionals when needed. For more tips, watch our webinar, Navigating Tax Season 2025 with Playground, or explore tools like Playground Payroll to simplify your tax filings. Here’s to a successful 2025 tax season.

Playground is the only app directors need to run their early child care center. Playground manages marketing, registration, billing, attendance, communication, paperwork, payroll, and more for child care programs. 300,000+ directors, teachers, and families trust Playground to simplify their lives.

Learn more by scheduling a free personalized demo.

See what Playground can do for you

Learn how our top-rated child care management platform can make your families & teachers happier while lowering your costs

Related articles

Stay in the loop.

Sign up for Playground updates.

Stay in the loop.

Sign up for Playground updates.

Stay in the loop.

Sign up for the updates.

© 2025 Carline Inc. All rights reserved.

© 2025 Carline Inc. All rights reserved.

© 2025 Carline Inc. All rights reserved.

Childcare Taxes 2025: A Comprehensive Resource for Providers and Guardians

Published Jan 14, 2025

|